Industry News

Industry News

Weak demand, production cuts have become the core of the current steel price evolution

Since mid-March, Shanghai rebar spot prices have fallen 340 yuan/ton. Steel peak season demand is less than expected, double coke weakness, cost collapse, steel negative feedback has been formed. In order to stabilize prices to complete the industry self-help, steel mills to reduce production is imperative.

1. The possibility of policy production cuts

There are two main ways to reduce production, one is a policy reduction, the second is the independent regulation of the market. Recently, there are several versions of rumors about the national crude steel production reduction in 2023, mainly "flat energy consumption compared to 22 years", "flat production compared to 21 years", "crude steel production -2.5% compared to 22 years " and so on. However, the author believes that the probability of policy suppression of crude steel production is relatively small.

The introduction of policies generally serve the larger strategic goals, to solve the main contradictions at the time, such as "three to a drop a complement", "carbon neutral, carbon peak". However, for now, the core of domestic policy is to stabilize economic growth, and all policies must be oriented to serve economic growth. Crude steel reduction is a contractionary policy, not in line with the current policy direction, and domestic steel demand down cycle has been opened, the market-oriented independent adjustment can achieve the purpose of de-crude steel, the need to take administrative means to reduce crude steel is low.

2. The difficulty of market-based production reduction

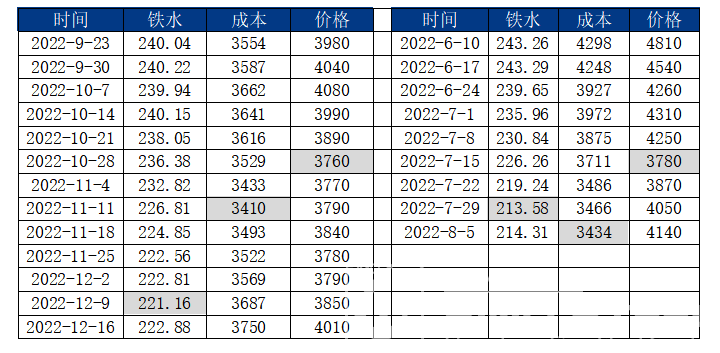

The current round of production reduction path mainly relies on the independent adjustment of the market. Steel prices fell for nearly a month, but iron production continued to climb, reaching 2.45 million tons by April 7. As with many large manufacturing industries, steel production is difficult to adjust downward. Larger equipment requires steel companies to have higher requirements for continuity of production, and heavy assets and high depreciation make industry profits more sensitive to the scale of production. When the scale is larger, the unit cost will be lower, in poorer profits but not into a serious loss, continued increase in production is a rational choice. According to statistics, the average ton of steel depreciation of listed companies in the steel industry in 2019 is about 186 yuan/ton, which means that as long as the ton of steel loss does not exceed 186 yuan/ton, steel mills are not too motivated to reduce production.

Industry attributes determine the difficulty of production adjustment, and the adjustment of production is slower than the change in demand, which is the root cause of the mismatch between supply and demand, and the root cause of cyclical fluctuations in steel prices.

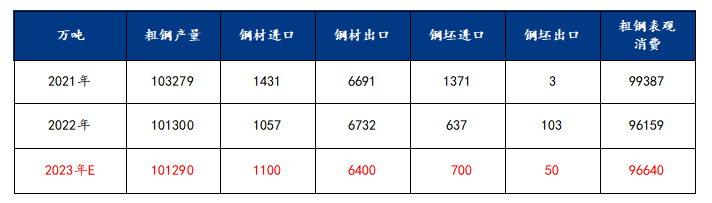

3.The equilibrium production of crude steel projection

Statistics Bureau data show that January-February domestic crude steel production of 168.96 million tons, an increase of 6.8% year-on-year, 247 blast furnace iron climbed to 2.45 million tons, at a high level for the same period. Production reduction has been imperative, how much to reduce production to achieve a balance between supply and demand is a more important issue. The essence of production is demand, the change in production is mainly regulated by demand. Thus, according to the logical idea of "demand-determined production, production-determined reduction" to deduce the amount of crude steel production reduction.

2023 steady growth policy frequently, real estate is in a weak recovery, crude steel demand is expected to increase 0.5%-1% year-on-year compared with last year. Assuming 0.5%, the crude steel table demand this year is 966.4 million tons, steel exports take the average value of 64 million tons in the past five years, steel billet and steel imports increased slightly year-on-year, the final projection to maintain a balanced supply and demand of crude steel production of 1012.9 million tons, basically the same as last year. This shows that the crude steel flat control is the most reasonable, just compare the crude steel year-on-year changes can be observed in the balance of supply and demand. For example, from January to February, domestic crude steel production increased by 10.74 million tons year-on-year, requiring a production reduction of 10.74 million tons.

4.The industry changes after the market-based production reduction

The impact of market-based production cuts on prices is generally divided into two stages, production cuts in the early stages means a decline in raw material consumption, which will accelerate the collapse of steel costs, thus inducing the formation of negative feedback, steel prices fall fast and furious. Production cuts to the middle and late stages, which means that steel supply will soon re-match demand, is expected to drive the futures before the spot to stop falling. Steel mills have not yet entered the production reduction phase, in the gestation period, which means that steel prices still have room to fall.

The adjustment of production is slower than the change in demand, which is the root cause of the mismatch between supply and demand, and the root cause of cyclical fluctuations in steel prices. In the foreseeable future, as steel mills continue to reduce production, steel supply will again fall, which lays the groundwork for a new round of price increases. mid-July is the peak of the rainy season, the lowest valley of demand, but also the period of the negative, with September and October peak demand is expected to approach and the second half of the real estate industry substantial demand recovery, the steel market will face a new mismatch between supply and demand, when Steel prices will open a new round of rising.

Previous Page:Steel prices will continue to fluctuate and rise in March

Next Page:Steel price trends

Online Order

Online Order

Whatsapp:+8617669729703

Whatsapp:+8617669729703

Email:sinosteel@sino-steel.net

Email:sinosteel@sino-steel.net

Go top

Go top